Decoding Grid Economics: Why Nodal Market based Price and Utility Tariffs are key to understanding US Energy Economics

Understanding how electricity flows and is priced in the United States is a complex puzzle. But for anyone serious about navigating the energy landscape—from developers and investors to policymakers and large industrial consumers— understanding exactly how those prices are formulated and calculated is far more intricate, especially in the deregulated markets. Two critical pieces of the information puzzle are Nodal Price Location Data and Utility Tariffs. Combining them unlocks a deeper understanding of energy costs and offers a profound insight into the intricate economics and opportunities on the grid.

Nodal Pricing: The Granular Reality of Electricity Costs

Imagine a vast network of roads, and each intersection has a dynamic, real-time price reflecting the cost of driving through it, factoring in traffic, road conditions, and fuel costs to get there. That’s essentially what Nodal Pricing, also known as Locational Marginal Pricing (LMP), does for the electricity grid.

Unlike “zonal pricing,” which assigns a single average price to larger geographical regions, nodal pricing sets a unique price for electricity at tens of thousands of individual “nodes” or connection points on the transmission system. These nodes represent where electricity enters or leaves the grid, such as power plants, substations, and major load centers.

Why is this locational granularity so crucial?

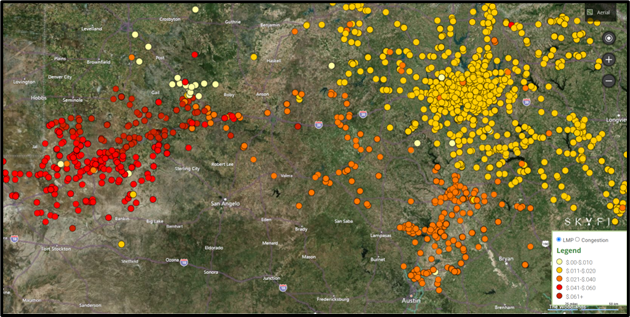

Nodal power data provides a granular view of electricity costs across the grid, reflecting the true value of power at each node. Each node has a different, fluctuating price published by the ISO every 5 or 15 minutes, while two nodes separated by only a few miles can have vastly different prices at the same point-in-time, so precise location matters too.

In major US electricity markets like ERCOT, PJM, NYISO, ISO-NE, MISO, and CAISO, nodal pricing is the backbone of wholesale power transactions. It allows for a more efficient and reliable operation of the grid, ultimately benefiting consumers by minimizing overall system costs.

- Reflecting True Costs: Nodal prices capture the real-time interplay of supply and demand at highly specific locations. They factor in:

- Generation Cost: The cost of producing electricity from the power plants online at that moment.

- Congestion Cost: The additional cost incurred when transmission lines are at capacity, preventing cheaper electricity from flowing freely to demand centers. When a transmission line is experiencing congestion it’s akin to a traffic jam on a highway, where slower, more expensive alternative routes become necessary. Rerouting the energy around these traffic jams faces alternative routing costs over different transmission lines, potential incurring more losses in energy.

- Losses: The energy lost as heat during transmission over long distances.

Additionally, Nodal pricing encourages:

- Correct Investment Decisions: Transparent nodal price data helps investors and developers make informed decisions about where to build new generation or transmission infrastructure, ensuring resources are deployed where they can provide the most value to the grid.

- Optimal Dispatch: Generators are incentivized to produce power where it’s most needed and where it’s least expensive to transmit.

- Strategic Siting: New power plants, especially renewables and battery storage, can be located in areas that minimize transmission costs and maximize returns.

- Demand Response: Large consumers can adjust their electricity usage in response to real-time price fluctuations, reducing demand during periods of high cost and congestion.

Clarity Grid provides a unified map of both the ISO nodes and Utility territories. Providing the linkage between the closest node and the right utility is vitally important for understanding the relationship between energy prices, tariff rates, and congestion on the grid.

(This is Part 1 of 4 Blog Posts for “Decoding Grid Economics”. Read part 2 here.)