In the past three years, the volume of energy storage resources (ESRs) on the US power grid has increased dramatically, encouraged in part by the tax incentives in the 2022 Inflation Reduction Act. 3,008 MW of storage was added to the grid in 2023, joined by another 4,255MW, mostly in CAISO and ERCOT. This influx of ESRs, which by their nature are both generation and load resources, meant utility companies and ISOs had to rapidly adjust their practices to accommodate this new mode of operation.

In the past year, a number of utilities in ERCOT, which has seen 1,511MW of storage added to the grid in 2024 alone, implemented tariffs on distributed energy storage resources (DESRs), which includes grid-scale merchant batteries. Clarity Grid maintains a database of tariffs for all seven US ISOs, as well as SERC and WECC alongside our comprehensive set of price history data at the price node level. In ERCOT, Clarity Grid also collects data series on the ancillary service awards and dispatch behavior of all of ERCOT’s 160 active merchant and co-located batteries.

By leveraging these data sets, we gain visibility into the economic impacts of these new DER tariffs throughout the state.

ERCOT Distributed Generation Tariffs

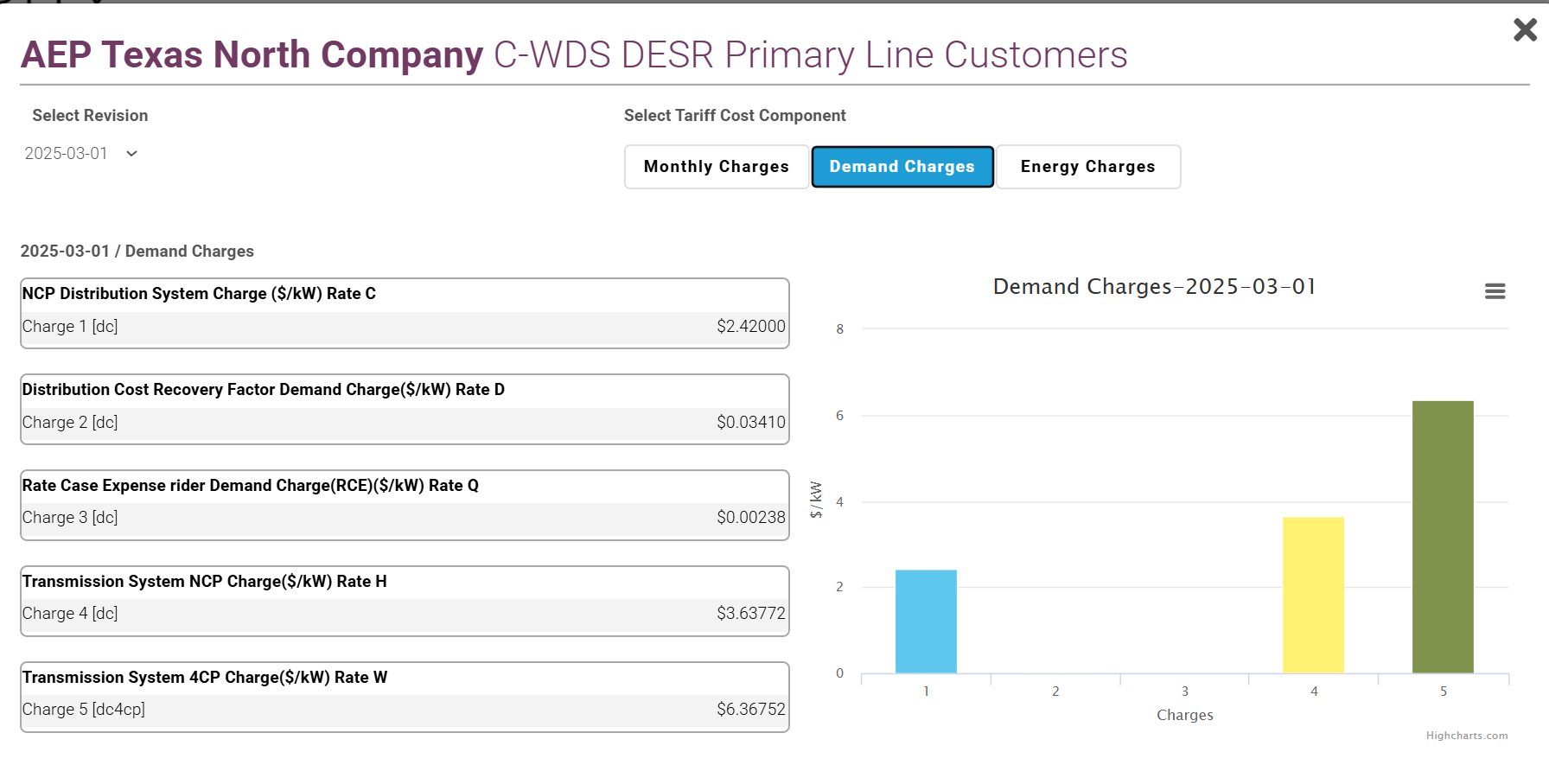

AEP Texas Central, AEP Texas North, Centerpoint and Oncor have recently implemented tariffs on ESRs. These tariffs are imposed on the load side only, meaning that a battery only incurs these costs when charging from the grid, which limits the economic impact.

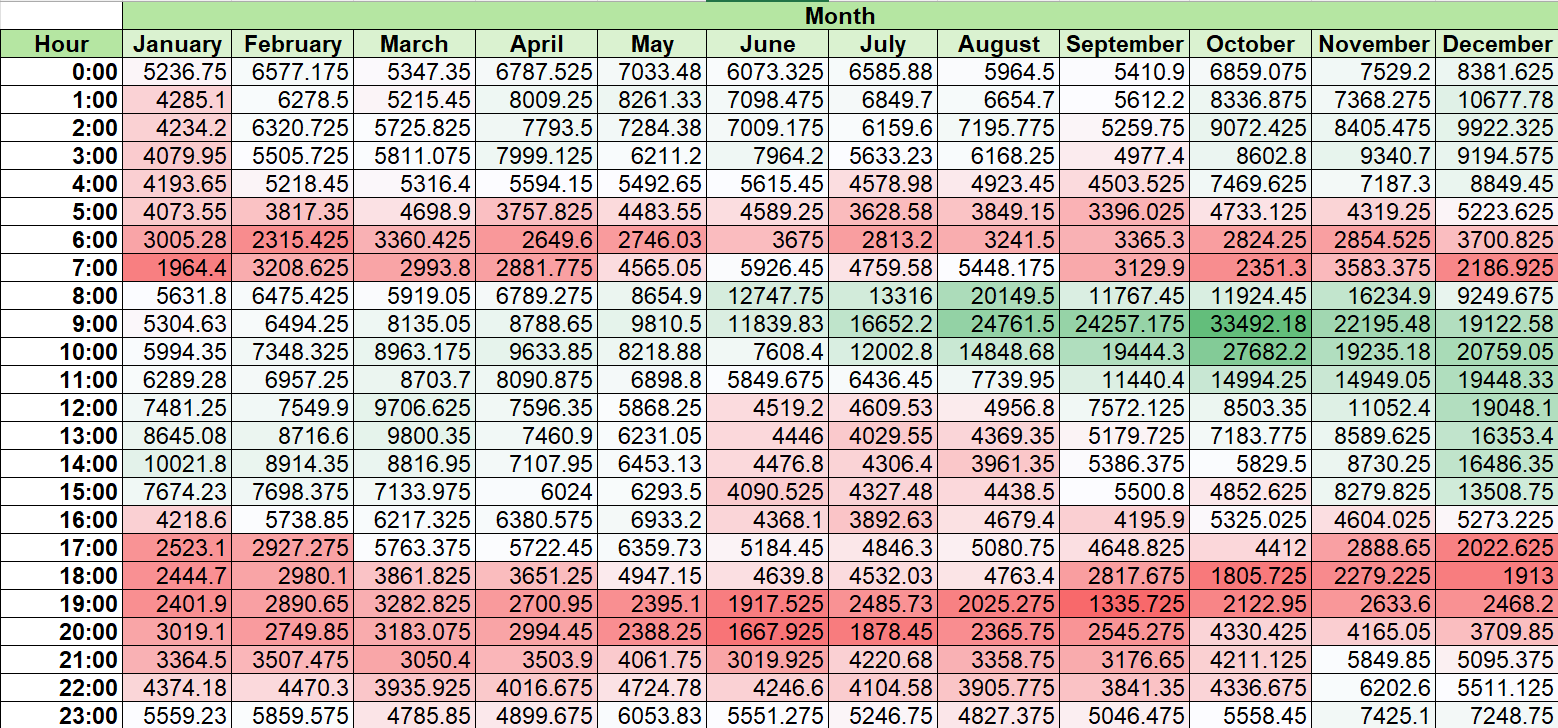

All of these DESR rate schedules include demand charges; those offered by AEP Texas Central, AEP Texas North, and Centerpoint include coincident peak demand charges. The coincident peak charges, which range from $0.67/kWh to $5.71/kWh, are significantly higher than the other demand charges included in these rates, which range from $0.03/kWh to $3.64/kWh.

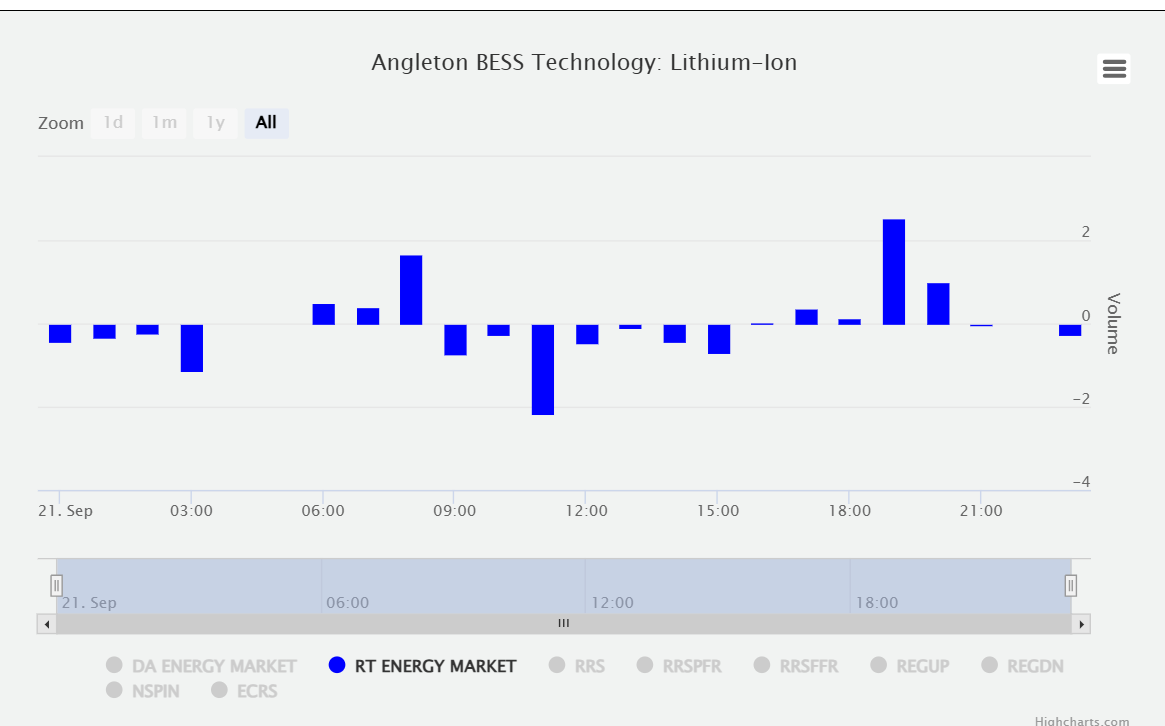

However, Clarity Grid’s data shows that the impact of these coincident peak charges is limited. By their nature, coincident peak charges are tied to times of maximum demand, when Real Time energy prices are higher, which means batteries are already disincentivised from charging at these times.

This pattern can be seen with the dispatch behavior of individual batteries, as seen in a chart capturing charging and discharging over a 24 hour period in September 2024, when the coincident peak charge was applied at 16:00.

Because there are multiple incentives to avoid charging at peak times, the actual impact of the DESR tariff rates can be as low as 0.6% of revenue for a high-performing merchant battery.

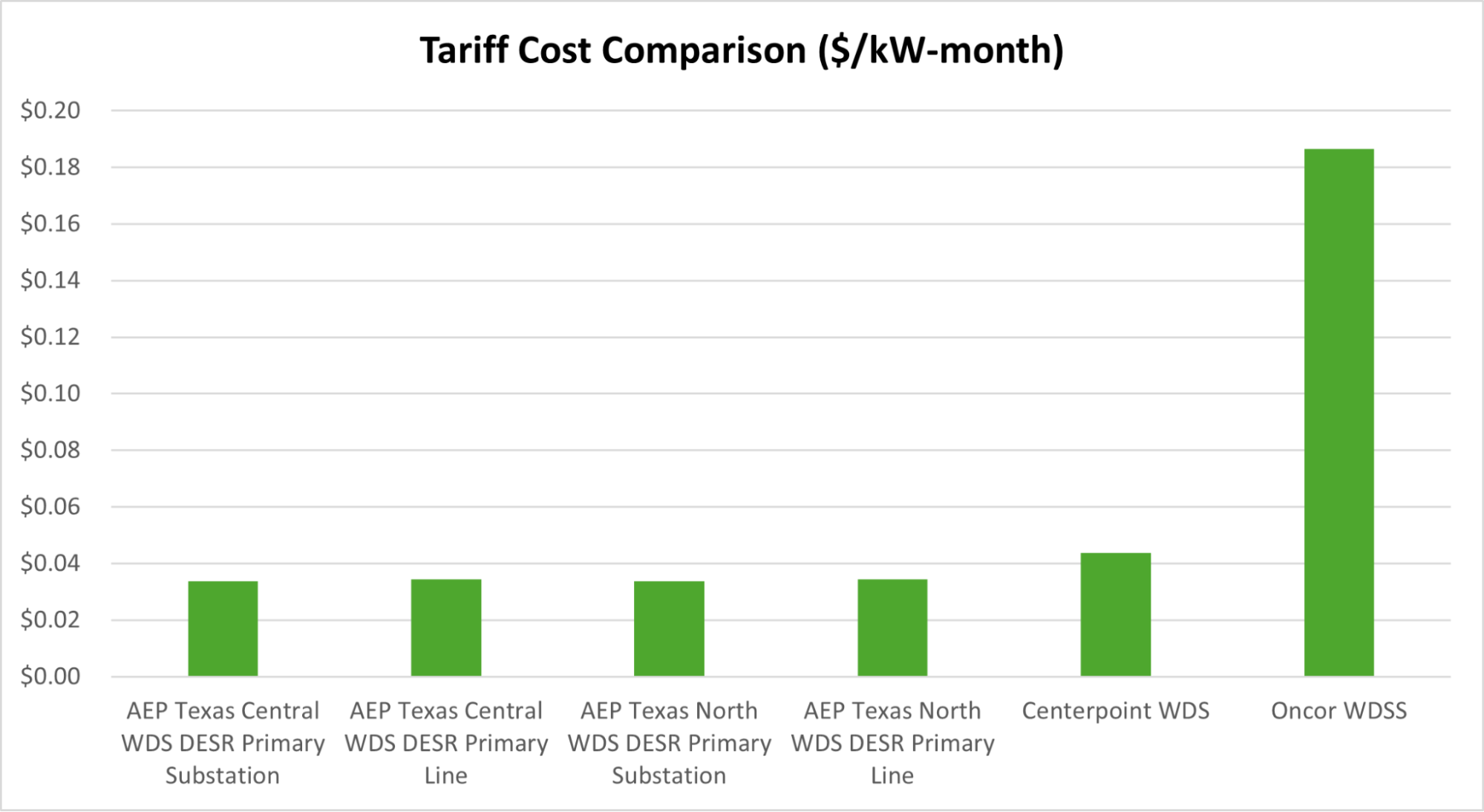

Because of the reduced impact of the demand charges, the most important factor in determining the economic impact of the tariff on battery revenue is the monthly charge. As a result, the most costly of these tariffs is the one with no coincident peak demand charges– the Oncor WDSS tariff, which has a total monthly charge of $1818.31. In contrast, the AEP and Centerpoint monthly charges range from $208.24 to $233.11.

To start a conversation with Clarity Grid about the details of this study or if your organization is considering originating new DESRs in Texas, please be sure to reach out us directly at dan@claritygrid.net or DM us on LinkedIN and please follow our page for more blogs reports that can give you key insights and analytics into the ever evolving landscape of grid economic.