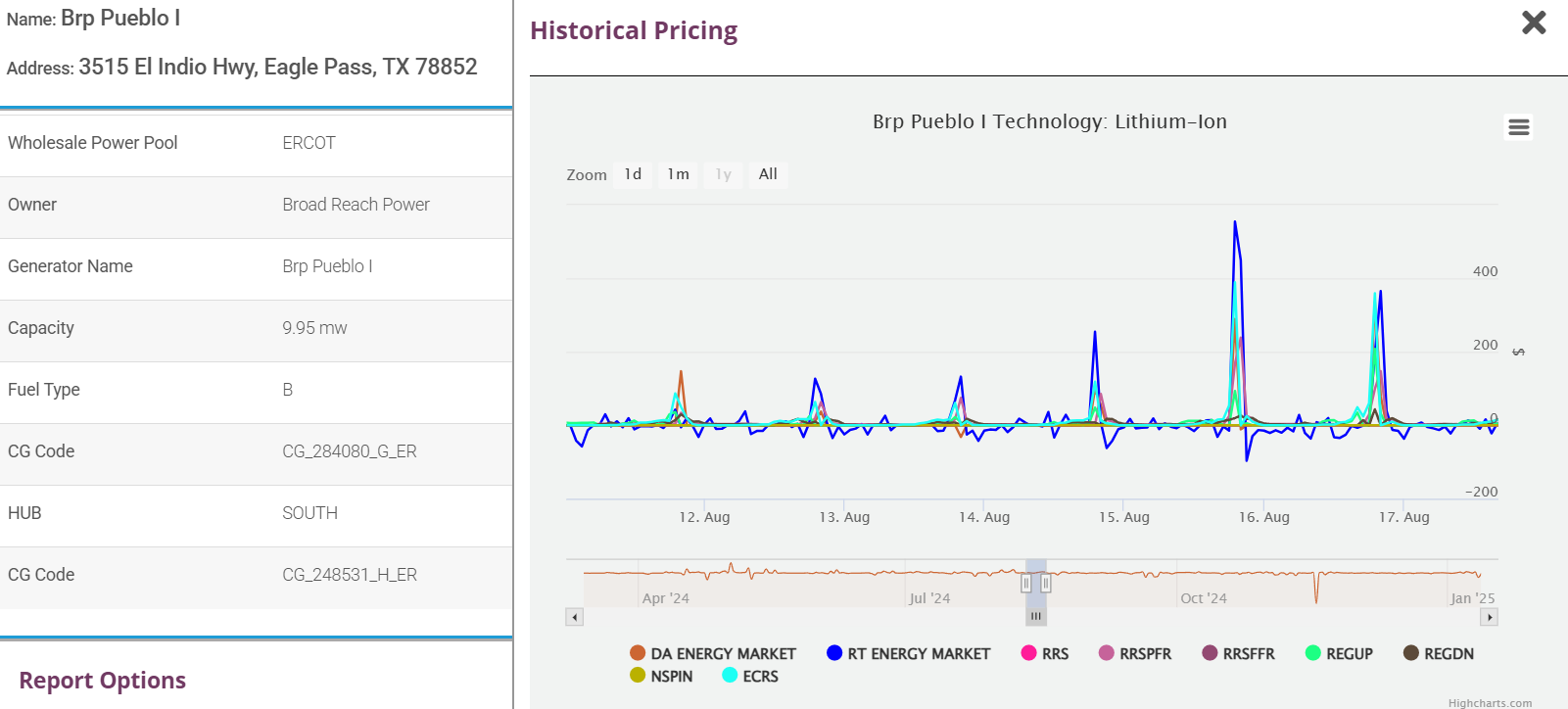

Clarity Grid Solutions maintains a comprehensive price node database of locations and hourly price histories for over 99% of price nodes within the seven US ISOs. Since 2023, Clarity Grid has leveraged this store of data to create comprehensive reporting on generation and renewable facilities throughout ERCOT. Unlike other reporting services, Clarity Grid offers an hourly breakdown of economics and dispatch behavior for generation and storage units as an hourly feed, updated daily on every node and substation in ERCOT.

This level of detail allows Clarity Grid to analyze and compare the economics and dispatch behavior of cohorts of storage resources. For example, we can see that ERCOT’s merchant batteries showed significantly different dispatch behavior than their colocated counterparts. Superficially, these two cohorts seem to have similar earnings, with average earnings of $4.03/kw-month for merchant batteries and $3.46/kW-month for colocated units.

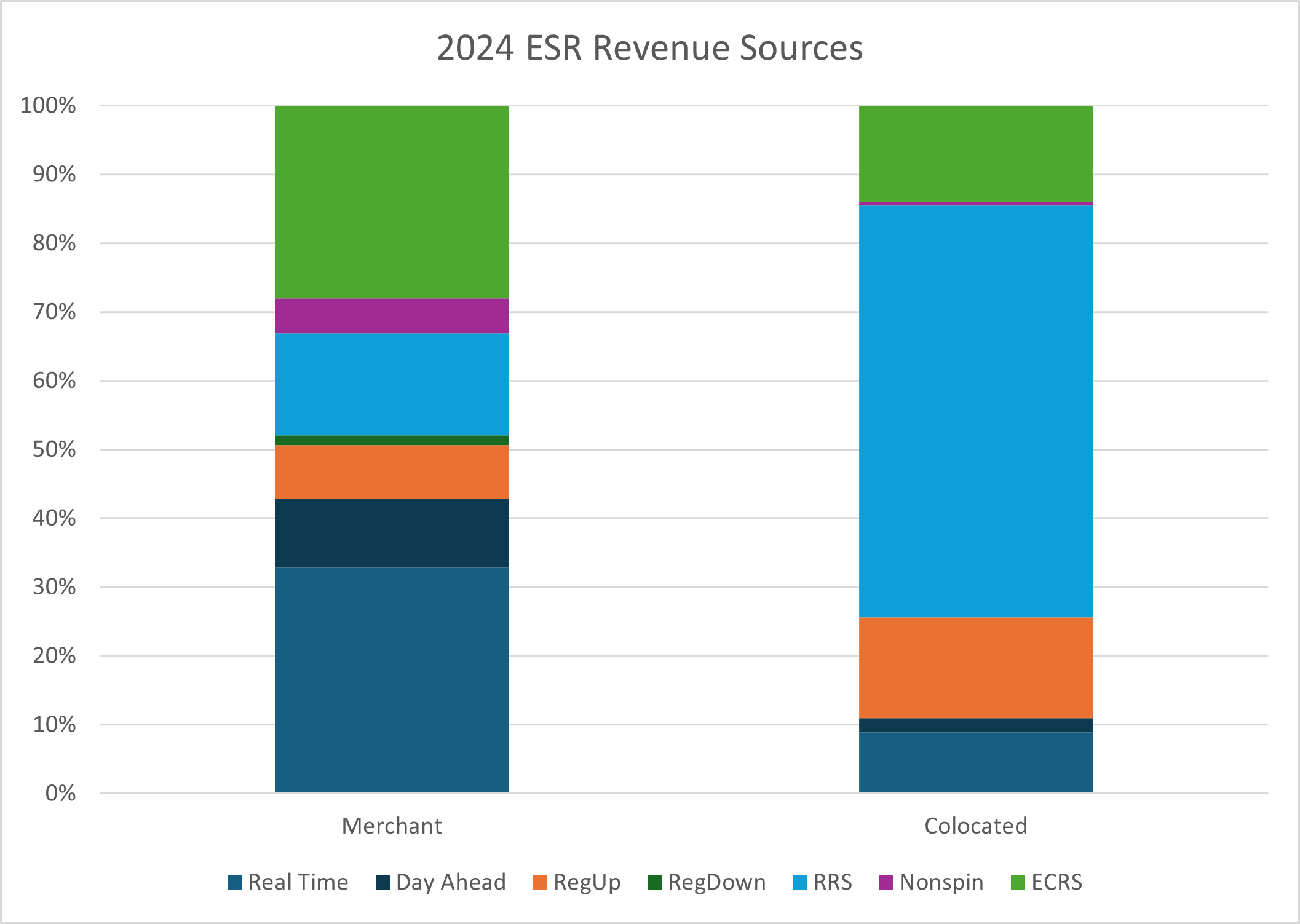

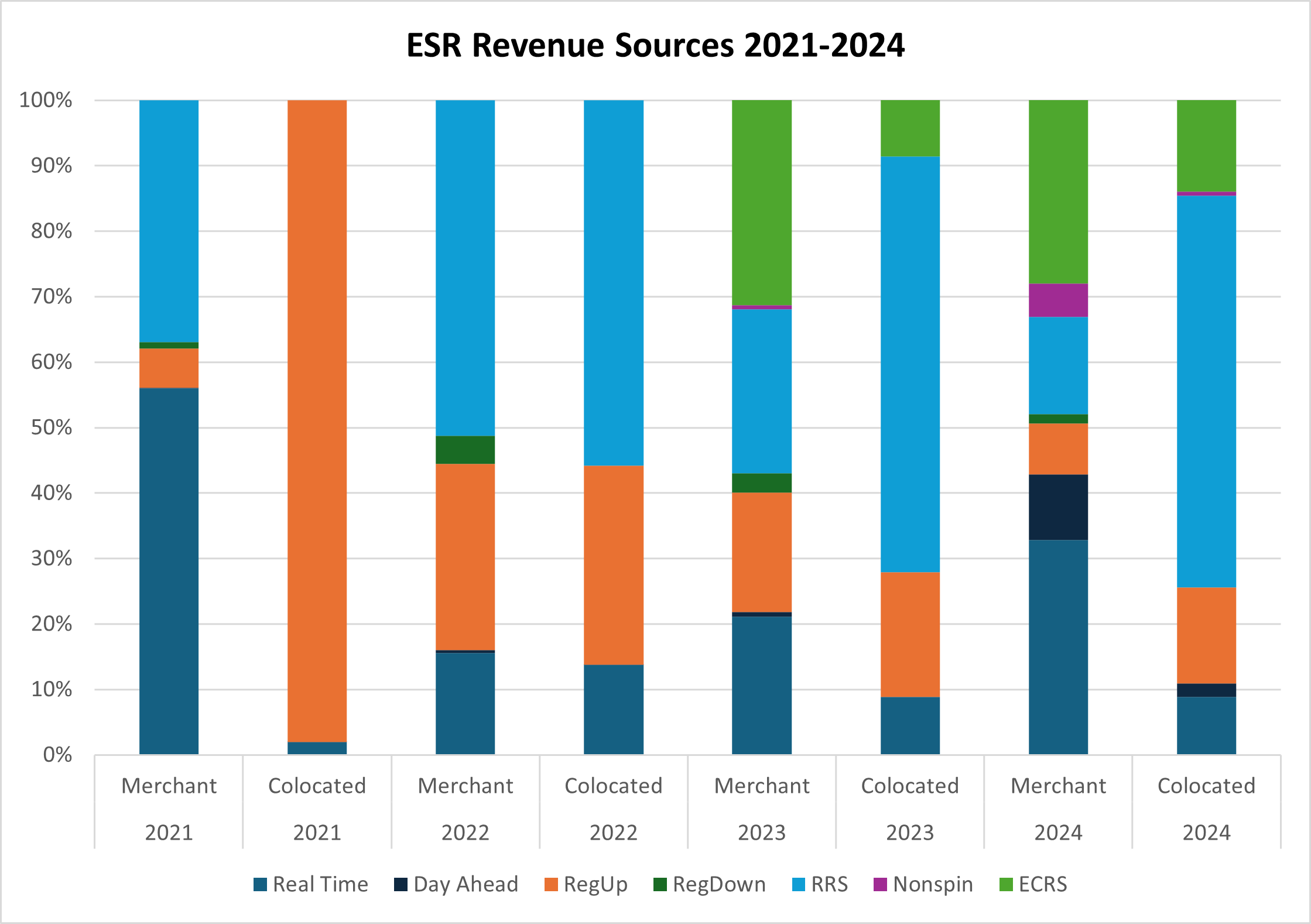

Merchant Batteries Vs. Colocation Storage revenue streams

However, the earnings profiles of these groups are significantly different, with merchant batteries earning 32.9% of their revenue from the Real Time energy market and another 28.0% from ECRS; colocated batteries relied on RRS, which comprised 46.5% of their total earnings.

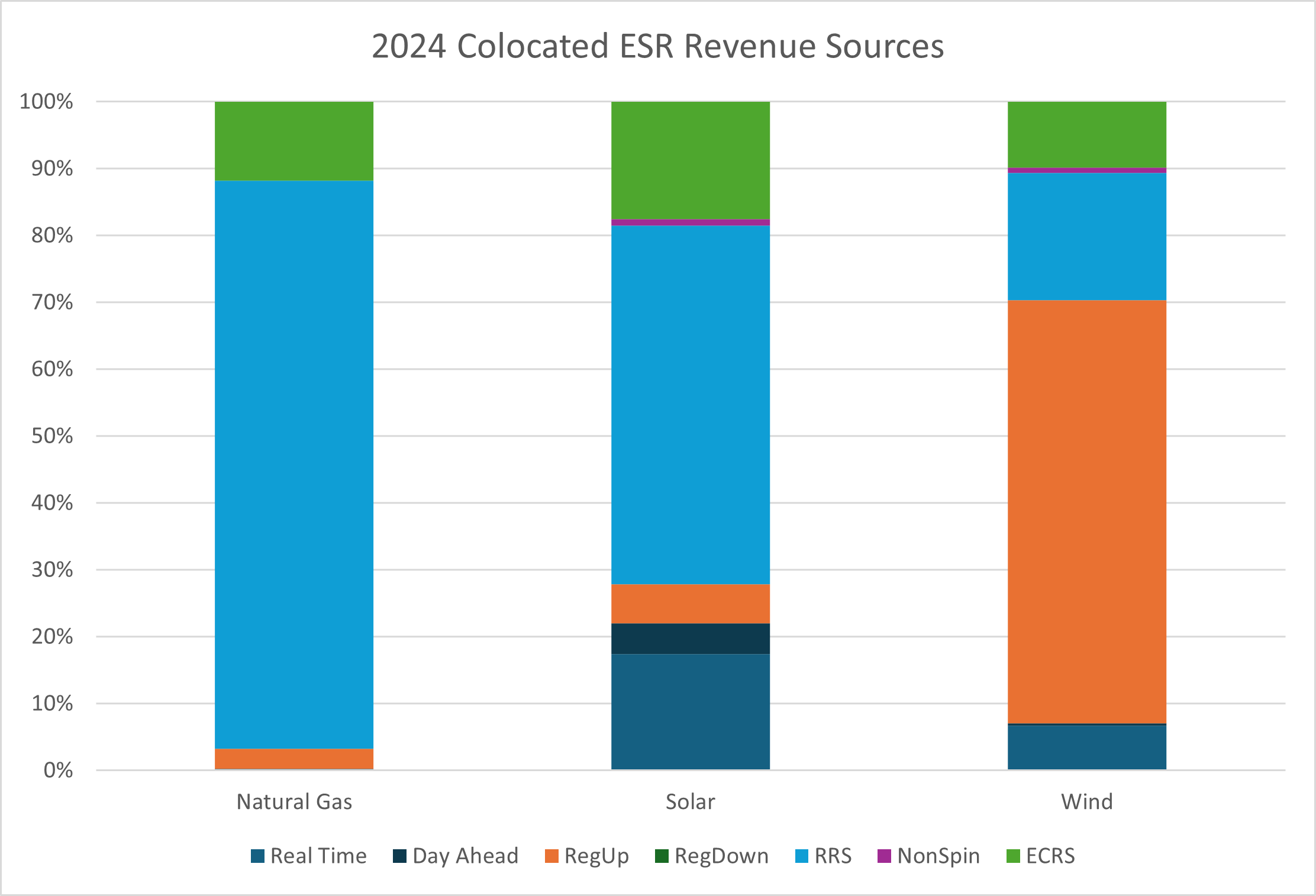

Drilling down further, we can even see differences within the cohort of colocated batteries, with sites colocated with solar or natural gas driving the RRS sales, while sites colocated with wind made a greater percentage of their revenue from RegUp. A greater percentage of RRS sales translated into greater overall earnings– storage units paired with natural gas outperformed units paired with solar or wind by $0.98/kW-month.

Delving into differences in revenue streams reveals information about which strategies were successful in the tough energy marketplace of 2024. For example, the highest-performing 10% of ESRs were 13% percent more likely to be regularly active in the Day Ahead market than their counterparts in the bottom 10% of earners. A greater variety of Ancillary Services sold was also correlated with relative financial success.

Besides the reporting feature, Clarity Grid uses this data set to train and refine our proprietary State of Charge Constrained Perfect Foresight model (SOCC-PF), which creates backcasts based on optimized battery dispatch strategies for one-hour and two-hour batteries for use in our Location Ranking algorithm.

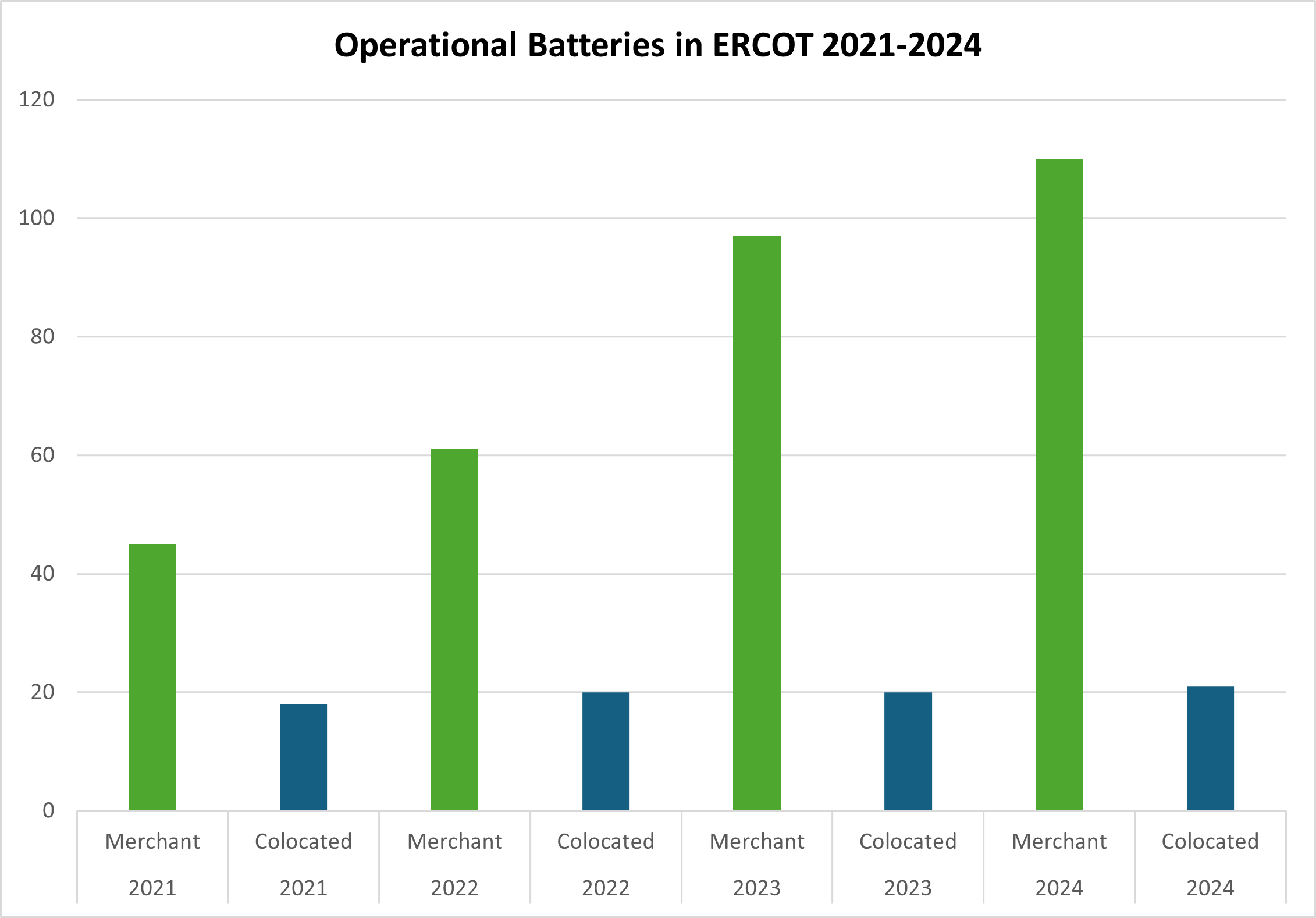

Impact of the IRA

The passage of the Inflation Reduction Act (IRA) in August 2022 had a significant positive impact on the development of energy storage infrastructure in the United States. First, Section 13302, which was originally intended to allow behind-the-meter solar and storage units to charge from the grid, this effectively allowed new co-located batteries the option of charging from the grid; colocated facilities constructed before the passage of the IRA were still required to get 75% of their charge from the associated generation unit to be eligible for the tax credit. The IRA also expanded eligibility for the Investment Tax Credit (ITC), previously available only to renewable generation, to cover stand-alone merchant batteries.

As a result, the number of merchant batteries in ERCOT increased dramatically during 2023 and 2024; in contrast, the addition of new colocated facilities slowed.

Battery development was not the only aspect of the energy storage landscape affected by these changes. In 2021, colocated batteries made 98.0% of their revenue from the sale of RegUp, while the few merchant batteries made a majority of their money (56.0%) from the Real Time energy market.

Increased wind and solar development in response to IRA incentives also drove demand for Ancillary Services. After 2022, colocated batteries began not only trading in the Real Time market, but diversifying their Ancillary Services sales, with RRS emerging as the largest source of earnings for these batteries. For merchant batteries, Ancillary Services quickly became the dominant revenue stream, accounting for 67% of their overall earnings by the end of 2024.

Be sure to “Like” Clarity Grid’s LinkedIN page to get our blogs in your feed and reach out with a DM to start a conversation on how our ESR and Generation Reporting can benefit your company’s market insights and analytics.