Electric Distribution entities across the US of all types (IOUs, Municipals, Cooperatives, and Government Agencies) have adopted similar pricing structures to serve their customers within their franchise service territories. These “tariffs” typically incorporate some type of fixed monthly cost ($), distribution cost by monthly volume ($/kwh), demand charge for peak usage ($/kw), and energy by monthly volume ($/kwh). Somewhat contrary to popular belief, it is only the energy portion of the bill (40-70%) which is available for competitive bid in deregulated markets. In these markets pricing structures can vary widely from: fully indexed to a market-based prices (daily/hourly), hybrids such as block and index where certain hours are fixed while others float, and fully fixed for the term of the contract which is clearly the most dominant form of contracting.

While only energy prices may vary by the time period in deregulated markets, Electric Distribution providers may vary all the elements of their pricing (except for their Monthly Cost ($)) by the time period of service, otherwise known as Time of Use (TOU). While Energy is the most frequent component whose price may vary within a given TOU Tariff, Distribution, and Demand components also can follow schedules where charges are higher when the overall electric grid realizes its greatest level of usage by hour, day, or even season (Summer vs Winter). Since capital upgrades to the wholesale or distribution grids are typically driven by the need to meet demand during peak usage periods, employing TOU pricing structures are meant to send price signals to the market to “flatten” daily or seasonal consumption profiles to avoid increasing the cost of service. Also, increasingly these variable rate structures are being used to encourage the adoption of solar, storage, or electric vehicle deployment at all levels of customer usage (Industrial, Commercial, and Residential).

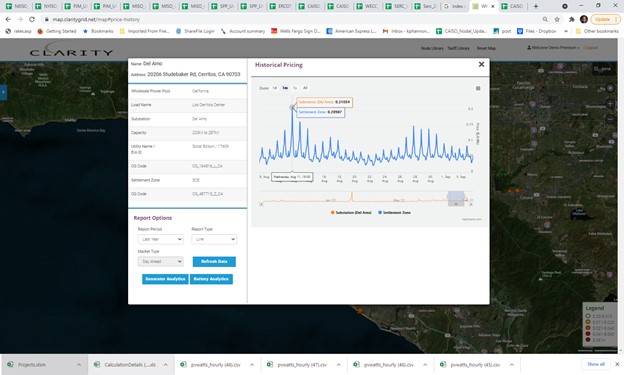

Regardless of the state of deregulation, Utilities serving customers in all markets organized around an Independent System Operator (ISO) (virtually the entire US, except for the Southeast and parts of the Western US) must procure supply at either Daily or Hourly market-based prices. It is against these prices that Distribution Utilities are constructing their TOU-based tariffs. An example of this mirroring of wholesale and retail prices can be seen in CAISO, specifically SoCal Edison’s Residential TOU tariff. The chart below shows the pattern of wholesale prices at both the Nodal point of Del Amo as well as the SoCal Zonal price (DLAP_SCE-APND) typically peak at 6 or 7 pm (18:00 or 19:00 hrs.).

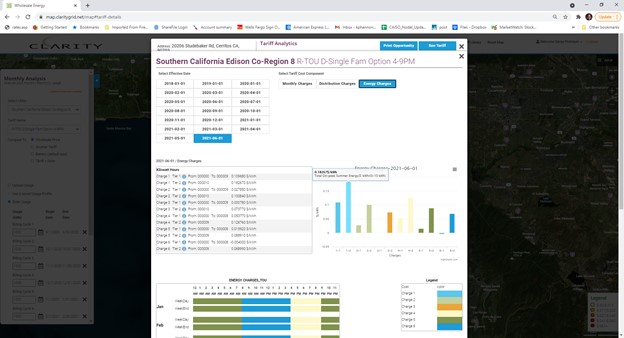

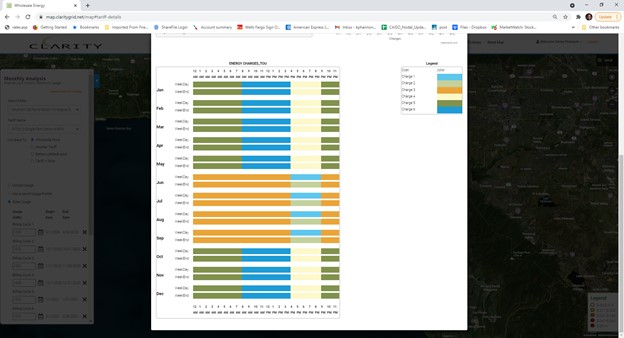

Meanwhile, a graphical display of the tariff elements on both the vertical bar as well as the pricing grid below shows energy pricing for the same August 2021 to be much higher in the 4-9 pm Peak period (16:00-21:00) $.18267 Peak vs $.07377 for all other non-Peak hours. It should be noted that this Peak period has lately begun to shift to the latter part of daylight hours as more solar generation has been brought onto the grid, the infamous “duck curve”.

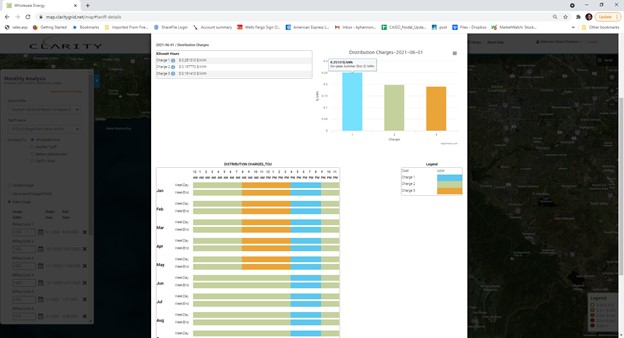

Furthering the incentive to shift consumption, the Distribution component of the bill is also scheduled to be higher ($/kwh) from $.25131 Peak vs $.19777 Off-Peak (see below)

Furthering the incentive to shift consumption, the Distribution component of the bill is also scheduled to be higher ($/kwh) from $.25131 Peak vs $.19777 Off-Peak (see below)

Geographically the ability to purchase electricity at a rate which varies by time tends to take on regional trends. These tariff structures are widely available in the Northeast (NEISO, NYISO), Middle Atlantic/Midwest (PJM with many Coops and Munis), less so in the Midwest and South (MISO, SPP) particularly for Residential tariffs, and almost non-existent in Texas (ERCOT), with none of the major Utilities offering TOU rates. Meanwhile, California (CAISO) by far has the most extensive TOU based pricing structures with PGAE even introducing demand charges which are assessed based upon a customer’s peak usage during peak periods measured against each day’s peak usage (S-Storage tariffs). The obvious incentive here to flatten loads through the use of battery storage at the customer’s point of consumption.

Accurate bill estimation for TOU tariffs requires good customer usage information down to the hourly (or 15-minute interval) level, as well as granular pricing for all types of charges and all hourly, daily, monthly, or yearly time frames. It is only with this beginning level of accuracy can a User, Broker or Consultant attempt to define the level of savings customers can achieve by varying their contracting structures, modifying usage, or deploy solar and or battery solutions. Clarity’s tariff engines contain over 9.000 tariffs for over 1,500 Distribution Utilities and are updated monthly. You can register for a trial at www.claritygrid.net.